Welcome to Health Care For All Forum

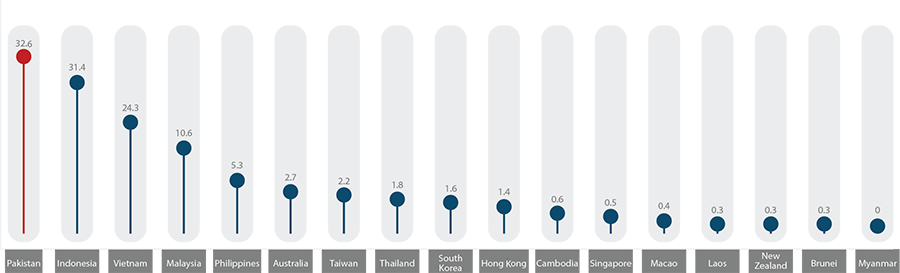

based on a study across 16 countries in Asia

In other countries, majority of the illegal cigarette consumption is in the form of smuggled cigarettes, however, Pakistan is plagued primarily by illegal cigarettes which are manufactured locally.

In 2017, off the 77.8 Billion cigarette sticks consumed in Pakistan, 41.9% of that market is captured by illegal cigarettes which account for 32.6 Billion non-tax paid cigarettes. In 2021, this led to an estimate

Illicit Cigarette Consumption in Asia for 2017 (Billion of Sticks)

“Only two tobacco companies, with a market share of around 60% contribute 98% of the tobacco tax collection, whereas all other tobacco companies operating illegally contribute only 2% to the national exchequer despite having a market share of about 40%.”

– Prime Minister Imran Khan’s speech on his ‘First 100 days in Government’

This is in violation of the Federal Excise Act 2005 set by Government of Pakistan which mandates a minimum legal price of a cigarette pack at Rs. 62.75. Therefore, this becomes a clear case of tax evasion as the tax to be collected on a pack of cigarettes is Rs. 42.11, whereas, the price for a pack of illegal cigarettes is far less than the amount of tax owed for it. In addition to the harm caused in tax revenue collection, the Low-price point of illegal cigarettes leads to smoking initiation especially amongst the youth as it makes it easier for them to get their hands on a pack of illegal cigarettes.

The Government of Pakistan has laid down strict laws against promotion of tobacco products, however,

showcasing people in their advertisements, holding lucky draws, giving gifts and incentivising users to continue using their illegal cigarette brands.